A recent column in the U.S.A Today makes the bold claim that there are less startups today than compared to the 1980’s, during the Carter administration.

The rationale:

At any rate, the latest data indicate that start-ups are becoming rarer, not more common. A new report from JPMorgan economist Mike Feroli indicates that employment in start-ups is plunging. New jobs in the economy tend to come from new businesses, but we’re getting fewer new businesses.

I am going to guess Glenn Harlan Reynolds, a professor and the author of the post, is not an entrepreneur and has never been one. If he was one he would know basing innovation metrics and the quantity of “startups” solely on the amount of people they employ is an incredibly flawed argument.

Diving deeper into the JP Morgan study, they lay claim to a few reasons on why we are seeing an apparent slow down in startups:

Hudson’s possible suspects for the slowdown: a) higher business taxes, b) Obamacare, c) an IRS crackdown on US employers that hire U.S. workers as independent contractors rather than employees, and d) a steady barrier erected to entrepreneurs at the local policy level.

But whatever the cause of the entrepreneurial decline, two possible impacts: 1) A less productive and innovative economy, and 2) higher profits for big business thanks to fewer upstart competitors on the horizon.

Here are a few observations on why I feel this assessment is off the mark:

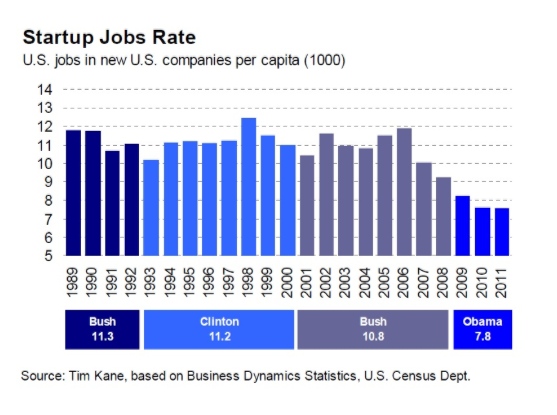

1) Assuming Obamacare is a factor completely misses the point, since Obama wasn’t even in office when the decline in jobs started (see chart above).

2) Although a local policy issue may influence certain industries – since we’re talking the entire nation here it’s irrelevant to include local policies because they vary state to state. I, for one, can tell you it’s quite easy to get going in your own new venture.

3) The IPO market really cooled off over the last decade, suggesting a rise in mergers and acquisitions. Simply stated, startups are being bought by bigger companies before they beef up their workforce, which also will affect overall startup employment numbers.

4) If anything, they miss the most obvious reason why people would choose employment at a larger corporation rather than a startup: job security and dependable paycheck in a shaky economy. Although this also doesn’t apply since the economy didn’t tank until late 2008 and beyond, so again, not a very high correlation.

5) The largest omission in this report can be seen by evaluating technological progress and the resulting drop in computing costs. Comparing the chart from the JP Morgan article and a graph of Moore’s Law (which is exponential) you now realize using a simple number like the number of employees of startups is probably the wrong approach when determining the current status of innovation. Moore’s Law states the computing power is increasing at the same time the cost is dropping. So, it is easier to start a business than ever before. The cost of computing, virtual work environments, AWS, instant and free communication tools, and the proliferation of the web have coalesced to create a startup nirvana. Looking at two charts from the same timeframe you will notice the stark drop in jobs at the same time a drastic increase in computing power? Coincidence? I don’t think so.

So am I missing something here?

Maybe if they simply stated “startups are employing less people” I wouldn’t have a problem with the report. But they didn’t. They claim (in fact lead with) the idea that there are less startups and innovation than in the 80’s and 90’s, which I feel is wrong – or at least how they came to that conclusion is currently flawed. They go on to make a few solid points regarding higher taxes and government regulation and how those influence an early venture hiring but lack any real depth for their argument. Maybe they should have consulted an entrepreneur or two who could help them sift through the chaff a bit further.

My take: it takes less people to achieve more today. What once took a team of 10 to accomplish now only takes 2 or 3 people and a wifi connection. So I am claiming the exact opposite of the USA Today and JP Morgan. We are seeing more products, apps, and startups created today than ever before. Ask any VC or startup founder and I guarantee they will say the same thing.

Hell, Instagram and their entire team of 12 employees was sold for almost $1 billion to Facebook in 2012. So whatever you do, do not believe there is a lack of innovation and startups out there. If anything, there’s more innovation and startups created each day than ever before because we can do more with less.

One just needs to look closer and use the right measuring stick.

Reblogged this on The Kids Are Alright and commented:

PREACH!

LikeLike